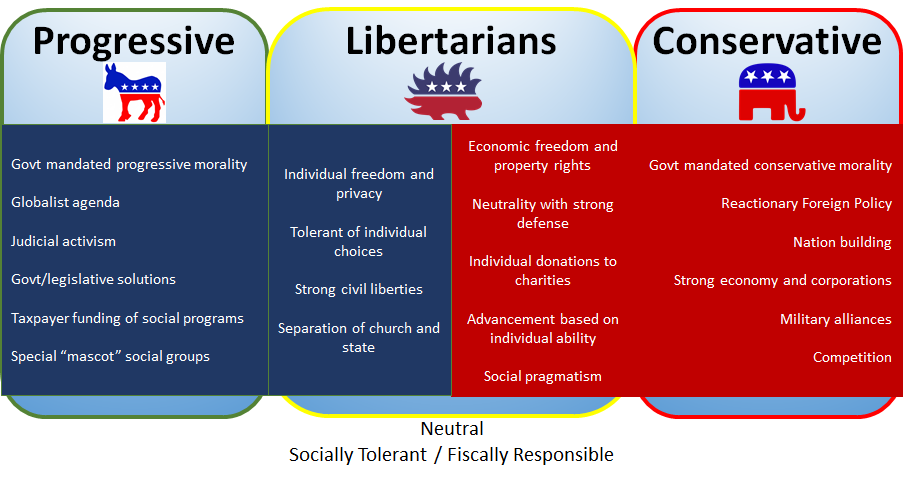

Alan: In the chart above, notice that EVERY time the word "individual" appears, it falls under the "Libertarian" heading.

Libertarianism is "rugged individualism pretending to be good," when at bottom, it is a quintessentially selfish political system, investing complete, gullible faith in the notion that "the invisible hand of the marketplace" -- WHEN LEFT COMPLETELY ALONE -- is the only mechanism by which "everything works out for the best" - spontaneously and without need of effort, intervention or virtue. And certainly NOT prioritzing "The Common Good" or "The General Welfare."

In the libertarian mind, all good things derive "automatically" by leaving "the invisible hand" alone.

Libertarianism: Anarchy For Wealthy People

Alan: Capitalism does not foster free markets.

Rather, capitalism corners markets until every one of them is taken over, in theory, by whichever trader is "most fit."

The word "pyramid" is often used to describe "the capitalist marketplace" because at bottom lurks the desire for one omnipotent potentate to reside "at the top of the pyramid."

In the libertarian's pyramidal view which always channels resources upward to the supposedly "fittest," other talents and other investors will be driven elsewhere by whoever emerges as "winner take all."

If (as Forbes correspondent John Tamny argues) smaller banks are forced to "merge again in order to compete," then (supposedly predictable) bank failures will rest squarely on the government's shoulders, with one lamentable outcome: "Hello bailouts again!"

According to libertarians, the real solution isn't stricter regulation - it's to stop regulating banks altogether.

We are assured that with complete deregulation, we'll "get what we've always wanted in terms of bank size, risk profile, innovation, and everything else that free markets always deliver without fail."

If you belief this last bit -- "always deliver without fail" -- there is a free market capitalist somewhere in Brooklyn waiting to sell you a bridge.

Libertarians are so intent on being "perfectly" right that they provoke the paradoxical effect of being entirely wrong.

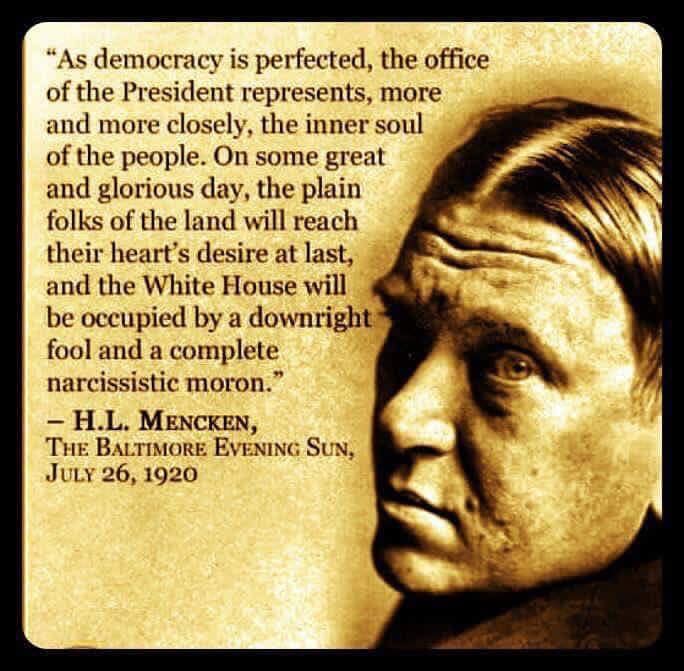

H.L. Mencken nailed it: "For every complex problem there is an answer that is clear, simple, and wrong."

There is no honor in libertarian oversimplification.

Instead, libertarianism is a modern manifestation of pharisaism.

"Here's how to be perfect..." even though no one, not even themselves, aspire to that goal.

"The terrible thing about our time

is precisely the ease with which theories can be put into practice. The more perfect, the more idealistic

the theories, the more dreadful is their realization. We are at last beginning to rediscover

what perhaps men knew better in very ancient times, in primitive times before

utopias were thought of: that liberty is bound up with imperfection, and that

limitations, imperfections, errors are not only unavoidable but also salutary.

The best is not the ideal. Where

what is theoretically best is imposed on everyone as the norm, then there is no

longer any room even to be good. The

best, imposed as a norm, becomes evil.”

"Conjectures of a Guilty Bystander" by Thomas Merton

"Conjectures of a Guilty Bystander" by Thomas Merton

http://en.wikipedia.org/wiki/Thomas_Merton

***

***

PS Given the banking model used by John Tamny, we actually find that credit unions -- small by their nature -- are the safest and most humane banks, offering small-scale, high-quality, low-cost, attentive service.

"Level The Playing Field: Let Credit Unions Offer Same Services As Commercial Banks"

No comments:

Post a Comment